Trump Escalates U.S.–China Trade War as Beijing Expands Rare Earth Controls, Raising Global Conflict Risks

Trade and export controls have become primary instruments of strategic competition between Washington and Beijing.

Executive Summary

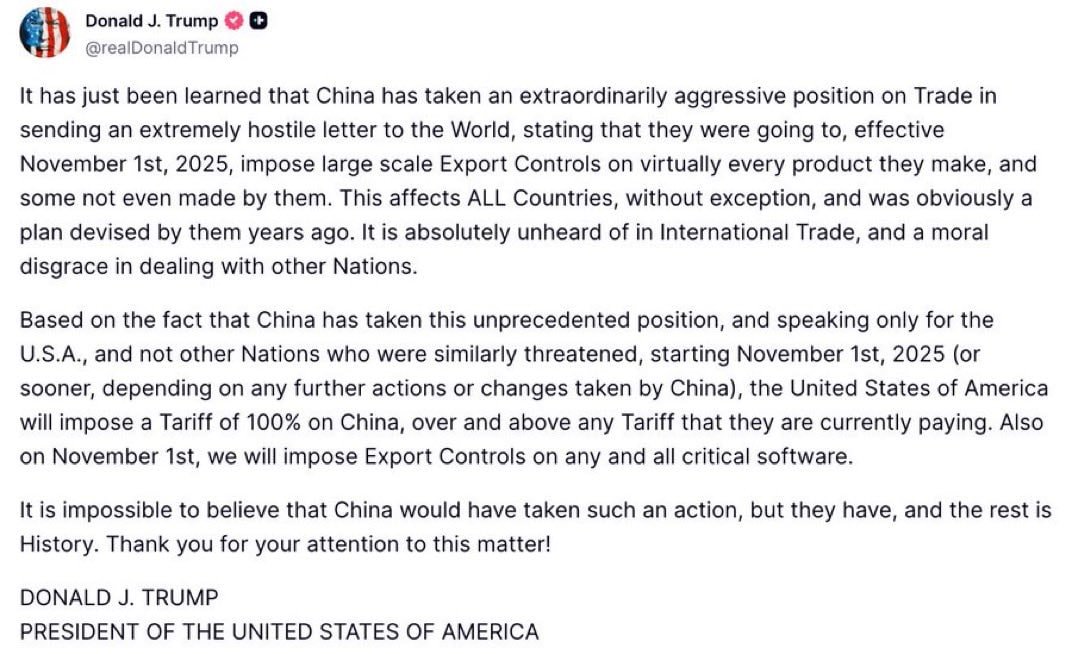

President Donald Trump’s decision to impose 100% tariffs on Chinese exports and restrict critical software sales to China marks a dramatic re-escalation of the U.S.–China trade war. Beijing’s retaliatory expansion of rare earth export controls has pushed bilateral relations into their most volatile phase in six months. The economic confrontation now intersects with rising military tensions across the Indo-Pacific, including a deepening China–Russia defense partnership and Beijing’s accelerating preparations for a potential Taiwan invasion. The convergence of trade, technology, and security flashpoints signals a systemic shift toward strategic decoupling and multi-domain confrontation between the world’s two largest powers.

Key Judgments

Key Judgment 1

The U.S.–China trade war has re-entered an escalatory phase that threatens to unravel global supply chains and destabilize financial markets.

Evidence: Trump announced 100% tariffs on Chinese goods effective Nov. 1, alongside sweeping export controls on U.S. software critical to AI and defense applications. China responded by expanding rare earth export restrictions and imposing port levies on U.S.-linked vessels. Global markets plunged, with the S&P 500 falling over 2%—its sharpest drop since April (Reuters, Quartz).

Key Judgment 2

Beijing’s rare earth export restrictions weaponize its dominance in critical minerals, signaling a strategic response to U.S. semiconductor and AI containment measures.

Evidence: China’s Ministry of Commerce added multiple rare earth elements and refining technologies to its export control list, tightening approvals and blocking military-use shipments. China accounts for 70% of global rare earth mining and 93% of permanent magnet production—key inputs for U.S. defense and clean tech industries (AP News, Fortune, CSIS).

Key Judgment 3

Trump’s tariffs and export controls serve both economic and political goals—leveraging trade confrontation to consolidate domestic support after the Gaza ceasefire and to reassert U.S. primacy in global manufacturing policy.

Evidence: Trump framed Beijing’s timing as “especially inappropriate” following his Gaza peace deal announcement, portraying China as undermining U.S. leadership. Analysts noted that the White House’s actions are designed to strengthen domestic manufacturing narratives and protect critical tech supply chains ahead of the 2026 election cycle (Fortune, SCMP).

Key Judgment 4

China is countering U.S. pressure with asymmetric measures—including logistical bottlenecks, regulatory obstacles, and military cooperation with Russia—to expand its leverage.

Evidence: Beijing announced reciprocal port surcharges, tightened customs inspections of U.S. AI chips, and launched an antitrust probe into Qualcomm’s Autotalks deal. Simultaneously, Russia agreed to equip and train a Chinese airborne battalion, signaling a new phase in Sino-Russian military integration aimed at deterring U.S. intervention in Taiwan (Forces News, Quartz).

Key Judgment 5

The probability of a future conflict over Taiwan is rising as China accelerates its capability development and coordination with Russia.

Evidence: Taiwan’s latest defense report warns that the PLA is increasing military exercises and developing airborne assault capabilities, cyber tools, and AI-driven hybrid warfare to prepare for a surprise invasion scenario. The RUSI report on Russia’s deal to train and equip Chinese airborne units suggests Beijing may advance its 2027 invasion timeline (Channel News Asia, Forces News).

Analysis

The renewed U.S.–China trade war marks a fundamental shift in the global balance of economic and security power. President Trump’s unilateral imposition of 100% tariffs and export controls reflects Washington’s growing belief that economic interdependence has become a strategic liability. By targeting China’s tech ecosystem and weaponizing supply chain access, the United States is not merely engaging in trade retaliation—it is engineering a decoupling designed to constrain Beijing’s industrial and military modernization.

Beijing’s expansion of rare earth export controls is a calculated countermove. As the world’s dominant supplier of these critical materials—essential for electric vehicles, advanced semiconductors, and precision weapons—China has effectively turned the tables on the U.S. by threatening a global materials crisis. This act of “geoeconomic coercion” mirrors the energy weaponization Russia used against Europe and reflects a broader shift toward economic statecraft as a deterrent tool.

The timing of these moves, immediately following Trump’s high-profile Gaza ceasefire, underscores the interplay between diplomacy and economic coercion. Trump’s portrayal of Beijing’s actions as an attempt to “steal the moment” suggests an effort to link foreign policy triumphs with nationalistic economic defense, leveraging confrontation with China to rally domestic support and project international resolve.

China’s strategy, however, extends beyond trade. Its coordinated escalation—tightened port fees, aviation restrictions, and regulatory barriers—represents a form of “bureaucratic warfare” aimed at grinding down U.S. commercial competitiveness through layered costs rather than overt confrontation. Meanwhile, its deepening partnership with Moscow is reshaping the Indo-Pacific’s military landscape. Russia’s commitment to equip and train a Chinese airborne unit capable of dropping armored vehicles into combat directly enhances Beijing’s invasion options for Taiwan. This development, coupled with PLA cyber operations and AI-driven psychological warfare, signals a comprehensive effort to erode Taiwan’s readiness and U.S. deterrence credibility.

The geopolitical implications are profound. The trade war, once confined to tariffs and currency disputes, is now a hybrid confrontation encompassing critical minerals, digital sovereignty, and regional security. The intersection of these crises—trade escalation, military cooperation, and technology denial—suggests that the next U.S.–China confrontation may emerge not from a trade negotiation breakdown, but from a miscalculation in Taiwan or the South China Sea.

Markets have already internalized this risk. With tech, logistics, and agricultural sectors reeling, and rare earth supply chains tightening, the global economy faces a structural inflationary shock. The U.S. administration’s outreach to India, Vietnam, and Nigeria for alternative agricultural and mineral partnerships illustrates a long-term pivot toward diversified sourcing—a tacit acknowledgment that decoupling is not temporary but transformational.

If APEC proceeds, the Trump–Xi meeting will likely be symbolic rather than substantive. Both sides have entrenched their leverage positions too deeply for rapid de-escalation. The emerging reality is that the U.S. and China are no longer competing within a shared economic order—they are constructing rival systems of trade, technology, and security that define a new era of strategic bifurcation.

Sources

Reuters – Trump ratchets up US-China trade war, promising new tariffs

Quartz – Trump and Xi haven’t even met yet, but their trade standoff has already begun

Fortune – Trump claims China holding the world hostage on rare earths is ‘especially inappropriate’

South China Morning Post – US soybean farmers push Trump to act as trade war deepens

Forces News – Invasion of Taiwan looking more likely as Russia strikes air assault deal with China

Channel News Asia – Taiwan defence report warns of increased Chinese military threat